Market research firm comScore recently reported that auto insurance companies with strong web presences are seeing increased traffic and shopping activity on their sites. While many auto insurance buyers are not converting on the web, instead finalizing policies offline, the report found consumers are becoming more comfortable conducting such business on the web and may soon begin purchasing online. According to the research, about 33 percent said they think they will buy their car insurance on the web in the future; this represents about a 2 percentage point increase from 2011, comScore said.

Like many other industries, auto insurance is seeing its prospects access web content to find the best value for their money. More than 3 million Americans purchased policies on the internet in 2011, which was a 6 percent increase from 2010. Even though most said they still are unlikely to buy a policy online, interest is growing steadily.

Auto insurance companies targeting these consumers can use content marketing to reach their target audiences more effectively. Given the growth of search as a primary starting point for research in preparation for any purchase, companies hoping to drive online sales can increase interest by focusing more on web marketing.

“…(W)hile switching consideration and online quoting have not grown significantly in the past year, consumers continue to show an increasing opennes to the possibility of purchasing their future policies online,” Susan Kleinman, comScore director, said in a release. “This bodes well for insurance providers who are able to meet the challenge of growing their online channels and customer acquisition strategies in the current market.”

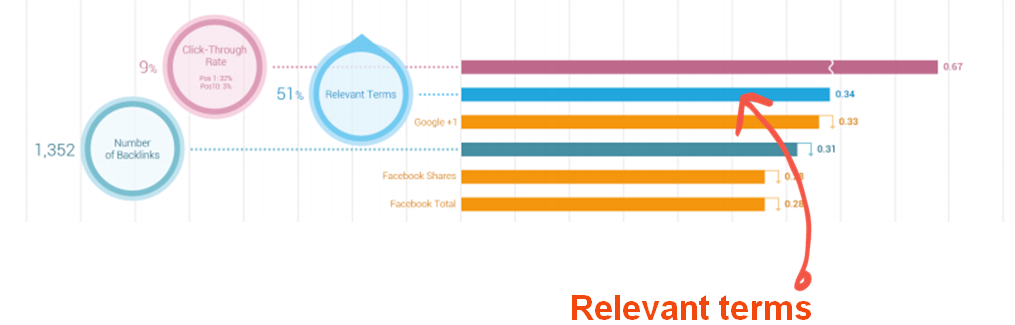

Insurance marketers can use the web to focus on both policyholder retention and customer acquisition. Brafton recently conducted a poll and found that content marketing with a focus on relevant, industry-specific articles and blog posts is a critical element of lead generation, and 86 percent of respondents said custom content has driven their lead generation capability. Additionally more than 85 percent plan to focus on news content marketing to drive leads. Companies in the insurance industry can adopt similar strategies to drive traffic to their sites and guide prospects through conversion funnels.

Moreover, retaining customers can also be accomplished on the web by using social media marketing. Brafton recently reported that 27 percent of companies with effective retention efforts named a strong social presence as their top tool for engaging and keeping existing customers.