Editor’s Note: Updated June 2020

Demographics change. Technology evolves. Interest rates fluctuate.

So what is a financial services firm to do if it hopes to navigate these developments?

The nimblest of companies that comprise “financial services” – banks, credit unions, alternative lenders, online startups, brokerages, financial advisors, etc. – are powering their websites, digital campaigns and consumer outreach with content marketing.

The nimblest of companies that comprise “financial services” – banks, credit unions, alternative lenders, online startups, brokerages, financial advisors, etc. – are powering their websites, digital campaigns and consumer outreach with content marketing.

Why?

Why?

The public needs real-time financial information, swears by customer data security and seeks advice on all things finance. Financial content marketing is striving to meet this demand.

Approximately 45% of financial services marketers report their content marketing is conducted on an “ad hoc” basis, meaning there’s still much room for improvement for companies looking to outpace competitors and redefine their relationships with customers.

Let’s walk through five examples of financial services marketing done right. What can you learn from these brands?

1. JPMorgan Chase & Co: Institute

Interactive content is a growing marketing specialty. It’s new, it’s engaging and it’s often more helpful than a static image or block of text.

JPMorgan Chase & Co highlights these facts with their web page devoted to data-driven research, which features a series of interactive maps, infographics and short, “Data Dialogue” blurbs and other quick-hitting but highly informative content. The topics they cover are exactly what the average consumer or even the industry researcher would want to know in 2020 and beyond.

Why it works

Nearly 90% of marketers say interactive content distinguishes them from their competitors. In the financial services sector, differentiation can mean everything, as many consumers select a financial institution based on location, convenience or existing family relationship. But interactive content allows a bank or credit union that may not fit into the above categories to break the mold, offering something that’s truly unique.

Attention spans are shrinking, and visuals are the perfect medium through which to maximize the brief seconds websites have to establish a connection between company and consumer. Interactive content requires more hands-on engagement from a site visitor, such that it goes beyond simply scrolling or scanning – visitors must participate in a digital exchange (i.e., hovering over an icon, clicking through an animated chart, rotating a 3-D map) to receive the information they seek.

JPMorgan Chase & Co illustrates the benefit of dynamic media for brand awareness and lead generation, and why it should be a cornerstone of every organization’s digital marketing.

2. Morgan Stanley: Ideas

Morgan Stanley combines an array of diverse content types under the simple moniker of “Ideas.”

Interested in knowing the latest technology driving finance innovation? Looking for proprietary research from one of the largest investment firms in the world? What about podcasts featuring commentary from top financial executives? Morgan Stanley houses all of these and more.

This information is generally geared toward a savvier investor or finance enthusiast.

Why it works

Churning out a similar asset (a blog, for example) on a familiar topic over and over creates a narrow impression of a brand.

Employees, analysts and entrepreneurs in the financial space want more than just the ordinary tips on how to save or how to invest. They like content that is tangentially related to their field and that may spark curiosity into a subject they previously may not have had experience in.

Morgan Stanley’s tangential approach to content keeps their Ideas page fresh, insightful and authentic. Plus, visitors can consume content visually or listen to it in audio format, meaning each day a new post is uploaded brings the opportunity for a new content experience – one that isn’t immediately expected (this type of thought-provoking content is made for sharing on social media and via email marketing campaigns).

Because Morgan Stanley already wields industry authority on these topics, it’s a good bet for them to diversify their content to capitalize on similarly related ideas.

3. NerdWallet: Blog

Unlike many of the other blogs on this list, NerdWallet doesn’t actually sell a financial product. The blog may be viewed as the most elementary digital marketing asset, but its importance cannot be overstated. A marketing team at a financial organization can take a lot of cues from NerdWallet’s content.

NerdWallet distills often-dense areas of financial interest into dedicated blog posts that any user can grasp. And with an exhaustive index of blogs spanning best practices for credit cards, investing, retail banking, loans, insurance, mortgages and money management, suffice it to say, they’re covering ideas the average consumer (e.g., millennials) wants to learn more about. NerdWallet is, in essence, acting as a free digital financial advisor.

Why it works

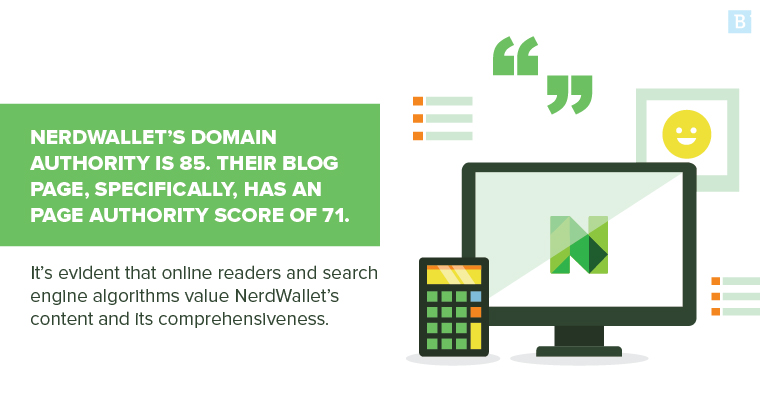

NerdWallet’s Domain Authority is 79. Their blog page, specifically, has a Page Authority score of 55.

It’s evident that online readers and search engine algorithms value NerdWallet’s content and its comprehensiveness.

With plenty of listicles, well-crafted headlines and approachable imagery, the millennial crowd is the obvious target audience here, and NerdWallet’s writing style says as much as well.

The blog page also does a great job of linking to expanded articles of interest after each section, in addition to providing a calculator or simulator at the bottom of articles, encouraging user engagement.

NerdWallet may not be the go-to expert for niche finance questions, but they know their audience, the questions that audience wants answered and the intent behind their queries, all of which are hallmarks of any great digital marketing program.

It’s like we said: All financial services marketers can learn something from NerdWallet.

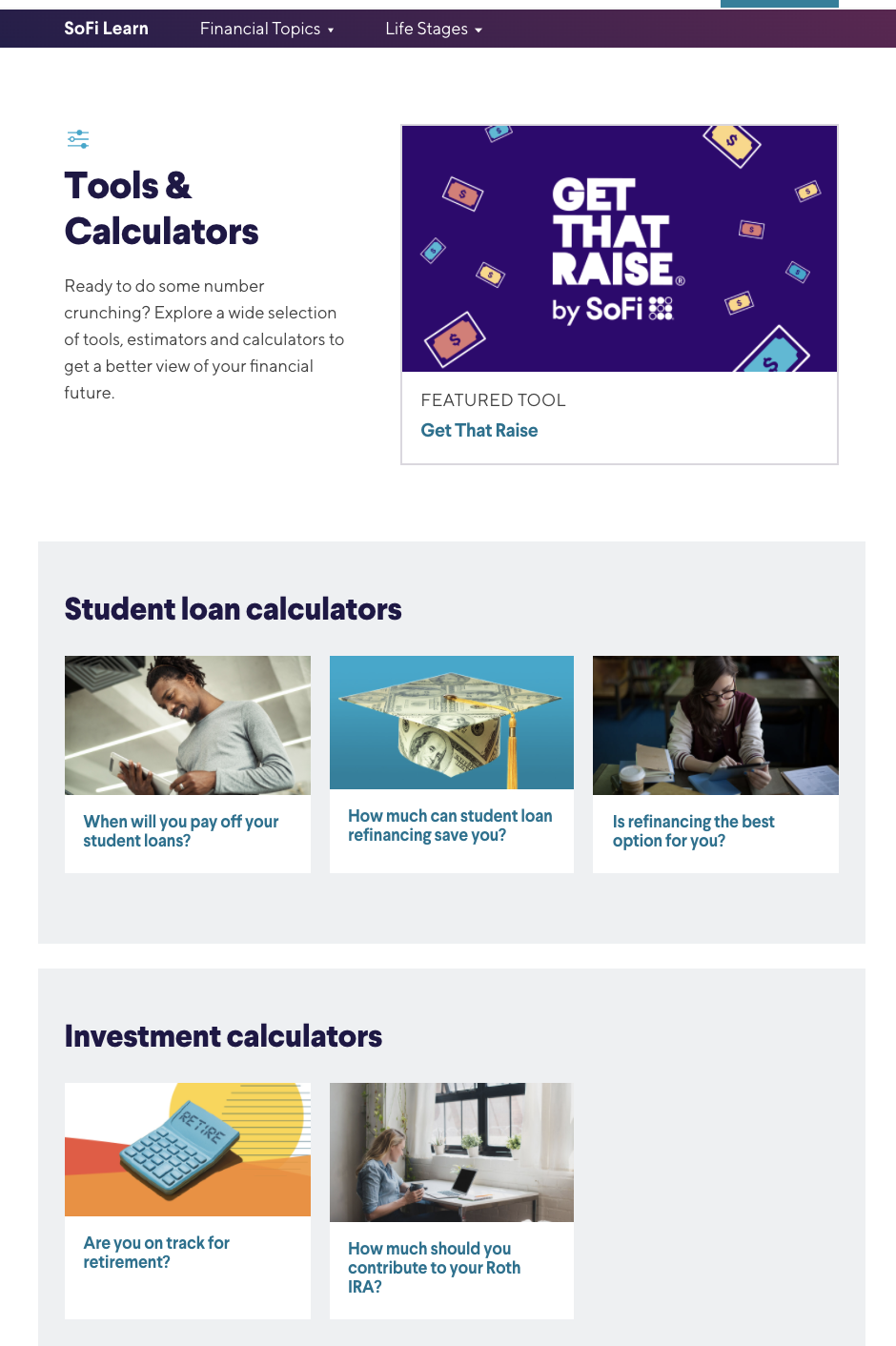

4. SoFi: Tools and Calculators

SoFi brands itself as a “modern finance company,” and – as a digital-only operation – they are a case study in financial services marketing.

Without brick-and-mortar locations, SoFi relies solely on its online applications, digital channels and innovative underwriting to avoid the mistakes of traditional financial institutions and simultaneously cater to the needs of their existing consumer and potential clients.

Their resource center is loaded with various calculators that tabulate and project important financial estimates, such as how long it will take to pay off a mortgage, which student loan plan is most cost-effective and IRA contribution limits based on tax-filing status.

Why it works

Math is hard. SoFi does it for you.

That’s a valuable differentiator that other financial services may not provide as a free, user-friendly tool. Better yet, SoFi calculators are native to the page, so, as information is entered, the calculator immediately gets to work computing and projecting numbers, rather than forcing users to click multiple “enter” buttons or navigate to separate web pages.

Calculators are a top-tier interactive asset that site visitors are already familiar with (aka they don’t need to be taught how to engage with the tool), which makes it more simplistic than other interactive content types like, say, maps or custom features that may come with a learning curve.

SoFi isn’t limited to calculators, however, as their resource center also provides expert advice, explainers and longer-form guides for the more involved user.

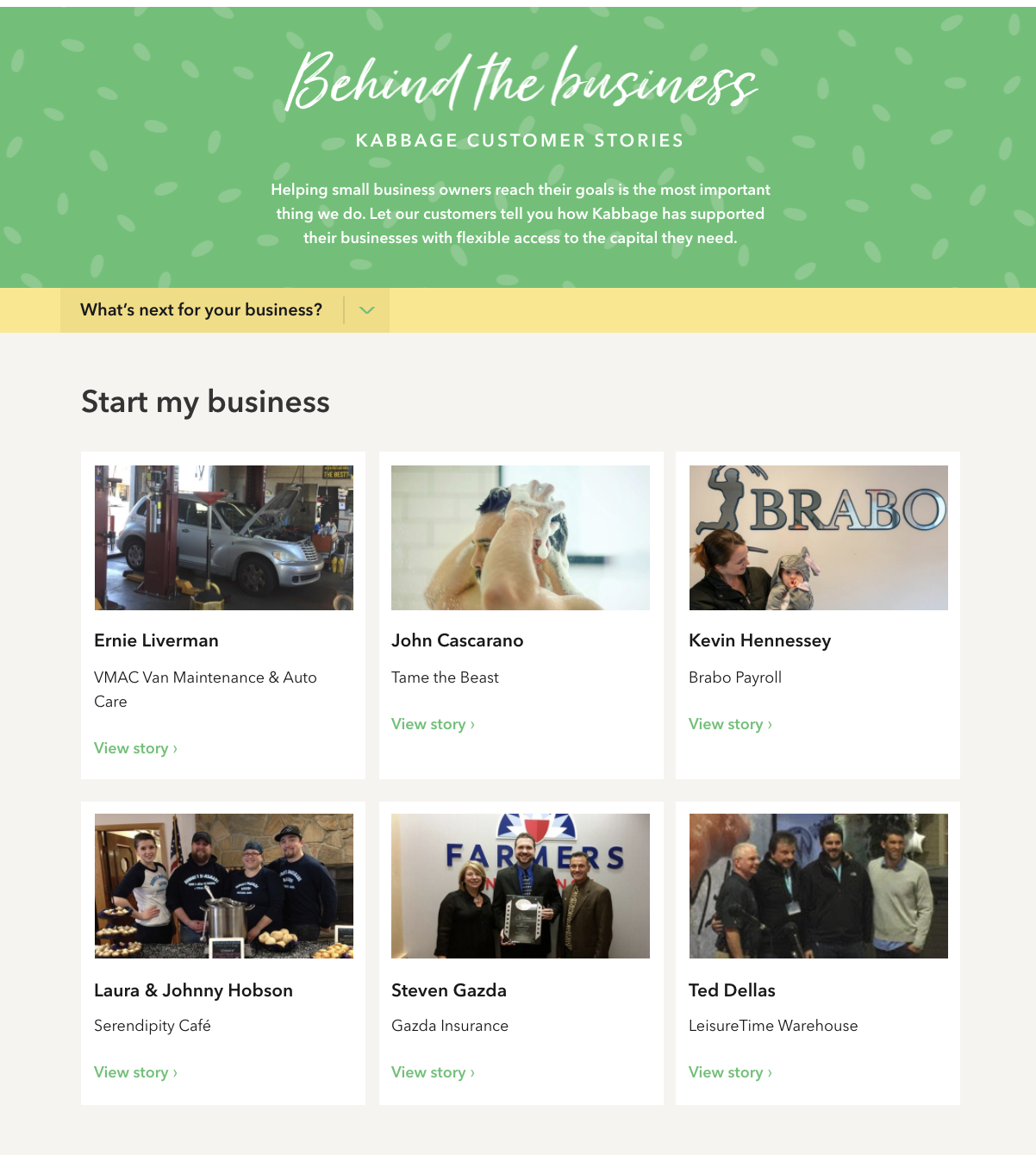

5. Kabbage: Behind the Business

Case studies and customer testimonials are bottom-of-the-funnel assets that are clearly revenue-driven. In this sense, they need to spur action and hopefully convert prospects into customers.

Ninety-two percent of people trust the recommendations of their peers, and testimonials are brands’ way of saying, “Don’t listen to us, listen to what your peers are saying about us.”

Kabbage, an online financial technology company with an automated platform for small businesses, understands that the more customer testimonials, the better. Known as “Behind the Business,” these tales provide all the reasons a prospect might need to become a client.

Why it works

Kabbage features digestible, relatable stories of everyday entrepreneurs and small-business owners, along with pictures and business information right on their Behind the Business web page.

Kabbage also spotlights the details of each business, including when it was founded, total number of employees, number of customers and other data highlights. By shifting the focus away from their financial service and onto their customers, they’re positioning themselves as more than just a financial services company – they’re showing deep-funnel prospects that they’re a partner who cares about the goals of their clients.

This nice, polishing touch on their website appropriately pushes prospects through the sales funnel and helps show ROI on their marketing strategy.

In conclusion

Financial services marketing isn’t all that different from other types of industry-specific marketing ventures. The underlying factor that stands out in the financial space, however, is how demanding and protective customers are relative to other business sectors with which they commonly interact.

We all have banking apps, go to ATMs, use direct deposit, invest through platforms and rely on web advice. Of course, money is involved – trillions of dollars of hard-earned money that drives the decisions of financial services prospects.

Marketing with intent, authority and, above all, customer trust in mind is a must, and the margin for error is much smaller. Inaccurate web copy could mean regulatory noncompliance, poor user experience could result in unsatisfied customers and ineffective marketing could lead to branding miscues.

Using the examples above, what lessons can your brand learn from high-performance financial content marketing? And what, if anything, will you do differently as a financial marketer going forward?