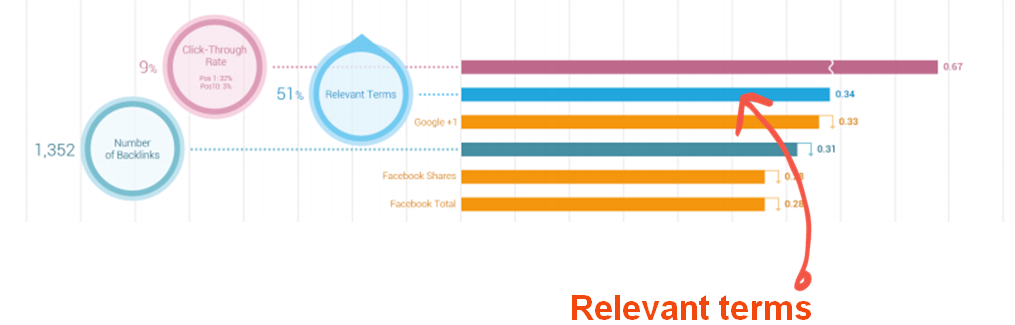

Financial service brands need to step up their loyalty marketing: Around 12 percent of finance customers plan to switch banks in 2012, up from 7 percent in 2011, according to a global survey from Ernst & Young. This trend is expected to continue as empowered consumers want more convenient options for on-the-go banking. Many brands are discovering online content is a way to offer personal service and vital information while supporting user-friendly digital touch points.

A study conducted by Harris Interactive found 74 percent of customers want to access their banking information on a computer, 34 percent check their finances via mobile application and 23 percent go to mobile web pages.

Even as 65 percent also visit their local branches for face-to-face interactions, web outreach is essential to nurturing business relationships.

Brafton previously reported the financial business sector is slowly embarking upon social media marketing to appeal to internet-savvy audiences. Financial professionals tend to use sites like Facebook and Twitter for their personal interactions, but have begun to LinkedIn for work-related interactions (33 percent).

These new channels may not have been appropriate venues for conducting transactions in the past, but that’s all changing and consumers want to engage financial institutions on the web. Marketers who fail to create dynamic content marketing strategies that answer questions and offer customer service online are missing opportunities to generate leads, conversions and loyalty.