Almost half of airline tickets are bought online, and Google is now making a move that could help it hold the lion’s share of travel-related searches. Google is poised to purchase travel software firm ITA for $700 million, reportedly beating out bidders including Expedia and Kayak.com. The acquisition begs the question, will the search giant try to overshadow some of the leading travel websites?

According to a statement from Google, the acquisition should be beneficial for online travel agencies, as well as passengers and airlines. The company claims it has no plans to set airfare prices or sell tickets to clients. Instead, it says its “goal is to build tools that drive more traffic to airline and online travel agency sites where customers can purchase tickets.”

The Google blog explains that the search engine believes its partnership with ITA will improve the travel-planning resources available to online consumers. Google will build on ITA’s offerings by organizing newspaper archives, books and images for travelers, as well as improving comparison shopping for consumers. The company is adamant that this deal will not change existing travel industry market shares.

A number of experts suggest Google may not pose a threat to other online travel companies if regulators approve the deal with certain stipulations. Antitrust lawyer Richard Brosnick told Reuters he thinks the deal will meet regulators’ approval under a set of conditions, such as requiring that Google and ITA uphold the software firm’s deals with travel companies, including Orbitz.

Even if these conditions are met, some legal experts and travel industry leaders worry that the ITA purchase will still give Google too much clout over the online travel industry. Kayak’s chief marketing officer, Robert Birge, said, “they have dominance on the general search side, When you couple that with ITA’s airline relationships there is reason to be concerned.”

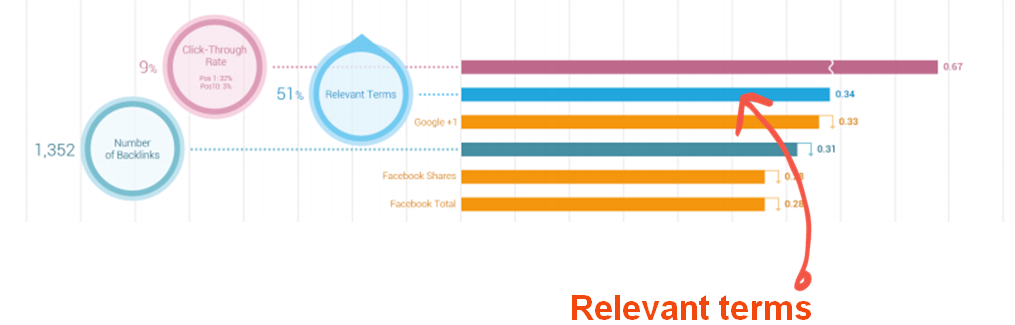

Indeed, Google does have dominance in the search industry, and it currently has a strong hold on travel-related searches. Hitwise data showed that Google’s share of the travel vertical dominates at 28.66 percent, but these numbers represents just a 6 percent increase over 2009. Meanwhile, Bing’s rise to 3.12 percent of travel-related searches, though far behind Google, represents a 63 percent increase for Microsoft over last year.

The Bing Travel page offers users a one-stop shopping site, with customizable features and easily intuited search options. Some believe Google’s acquisition of ITA is an attempt to protect itself against Bing’s rise in the vertical.

Caris & Company analyst Sandeep Aggarwal told the International Business Times he estimates that travel-related searches accounted for 10 to 12 percent of Google’s $24 billion revenue in 2009 – a share it does not want to lose to Microsoft.

With Forrestor Research predicting that the online travel services market will reach $111 billion by 2014, there could be a lot at stake in this deal for Google, Bing and online travel companies. Fasten your seatbelts.