According to The Wall Street Journal, Facebook insiders say the company is on track to earn $2 billion this year, and its valuation is jumping from $50 billion to $70 billion. As rumors fly about the price for Facebook's IPO, social marketers should take note that big numbers indicate the major effects the site is having on online businesses and advertising.

Brafton has reported that Facebook display ad impressions were driving growth in the market at the end of last year. Plus, Mark Zuckerberg's network is expected to propel social ad spend beyond $3 billion this year.

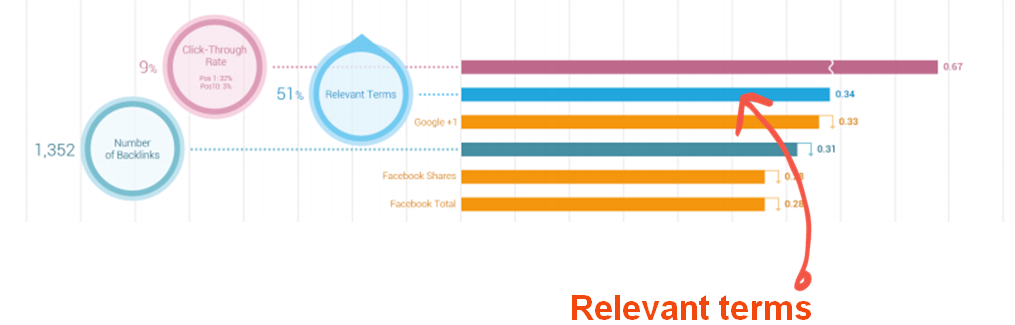

The site's hundreds of millions of users likely play a large role in distributing the 27 million pieces of online content shared daily. As evidenced by a study from Janrain covered by Brafton, Facebook is consumers' top network for sharing online content. Accordingly, brands are trying to make themselves part of the online conversation.

Additionally, the company is now moving toward ecommerce options, offering Credits and giving merchants the option to open social storefronts. Facebook has also released figures suggesting that Likes translate into revenue for brands on its site.

With this in mind, industry experts still believe Facebook is only just coming into its own as an advertising and marketing channel – and this is ramping up the network's estimated value. “Part of our bullishness for Facebook is our belief that it is still in the embryonic stages of advertising,” The Wall Street Journal quotes Wedbush Securities analyst Lou Kerner as saying.

As Facebook's value rises, marketers must consider its increasing importance as a marketing channel. The Social Media Examiner reports that 75 percent of marketers plan to increase investment in Facebook outreach this year, making it not only a potentially profitable endeavor but a competitive necessity.