Verizon recently purchased Yahoo for a bargain of $5 billion, and they couldn’t care less about owning the obsolete web directory, or its second-rate algorithm. What the communications giant was really after when they acquired the 21-year-old former tech and search pioneer, was its content, which is still widely distributed and popular.

Verizon wants in on the content game

While Yahoo’s search function has seen a significant dip in use over the years, its News, Finance and Sports channels are all still very popular, and help the company get about a billion monthly visits. These high-traffic resources have been important for Yahoo’s presence over the years, and will now benefit Verizon’s reach, traffic and ad revenue.

If we think back to last year when Verizon acquired AOL – another vestige of dot-com bubble era internet – the motives were similar. Verizon wasn’t focused on owning the little yellow man, bringing AIM back to life, or owning the rights to the iconic phrase “You’ve got mail.” They wanted AOL’s sports, entertainment and news pages, as well content from their subsidiaries – most notably Huffington Post and TechCrunch.

Content is king, and Verizon is milking it for all it’s worth.

Consumer data has switched hands

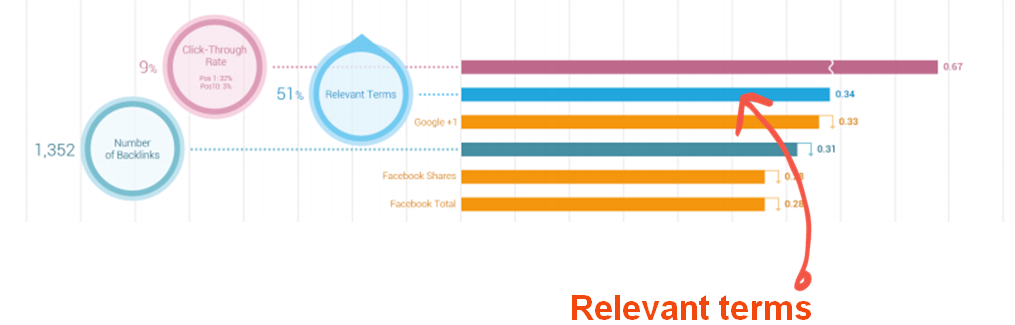

With users and content comes data, and Verizon has now inherited oceans of it, which they will use to help fuel their advertising campaigns. Verizon has now become the third-largest digital platform for online advertising following the acquisition of Yahoo, according to Fortune. And the billions of points of user data that they can now call their own are the final ingredients for elevating their audience targeting abilities.

From your email address (and the conversations you have), to the geotagged information in your pictures, to trash talk in your Yahoo Fantasy Football league, Verizon has access to your patterns and interests. They’ll also conveniently now own two of Yahoo’s more recent assets – Flickr, which serves 10 billion images to over 100 million users, as reported on the site’s blog, and Tumblr, which connects over 100 billion posts to 500 million people, according to AdWeek. All of these data points help target specific audience personas, and in Verizon’s case, deliver ads more effectively.

Content goes to waste without a solid platform

As a major wireless carrier, Verizon already owns plenty of phone contracts and the cell service to support them – now if they could only capitalize on the content that travels through their service and to their customers’ devices. To tap into this market, they’ve been pushing their own short-form mobile video content service, Go90, for about a year. If you haven’t heard of it, that’s because they haven’t yet had much success with securing big-name shows or producers, and most of their material has been met with average (or below average) reviews. Verizon knows they’ll need a major injection of video content to compete with the likes Netflix, Hulu and Amazon.

Verizon needed a better platform to release its video content on. It just so happens that Yahoo has quietly been doing very well in the mobile video space – and Verizon took notice. Though Yahoo’s video content is not intended to compete with the major TV and movie streaming services, the videos that populate their sports and news sites are popular, and their mobile video platform is a major money-maker. Verizon knew that behind every successful and engaging video is the right platform that connects the content with the audience.

The marketing implications of the Verizon-Yahoo deal are simple: Digital content is gold when you know who you’re targeting but it is only as powerful as the platform it is delivered on. The content that Yahoo publishes and distributes has become even more valuable than its original search product, which dominated the mid-nineties internet, back when I was just a Yahooligan.

The power of content couldn’t be more clearly exemplified in this deal: A communications juggernaut, worth a quarter of a trillion dollars, bought a shrinking, past-its-prime company for “pocket change” to own and leverage its content initiatives. Yahoo’s widely distributed content capabilities will provide Verizon with the ability to both expand their digital advertising endeavors and continue to reach wider (and younger) audiences.